Let’s say you own a junk removal enterprise, and also you get a job to scrub up an old constructing. Your staff wages is considered price of income, so on this state of affairs you’ll have $90 in direct labor prices that may be included in your price of revenue. The Cost of Items Bought (COGS) represents the whole direct costs that go into producing the goods a company sells during a particular interval. These prices embody supplies, manufacturing, packaging, and any labour instantly involved in creating the product. This prolonged method captures nuances that the essential method may miss, offering a extra cost of goods sold for a service company exact image of your precise prices incurred for goods offered. Legislation corporations, consulting companies, restaurants, salons, and different service companies all depend on precisely calculating COS to make sound enterprise decisions.

- Service companies must ascertain whether or not the IRS considers their choices as a taxable service.

- Their gross revenue relies on COGS, whereas web profit comes after subtracting operating bills.

- Figuring Out the cost of items offered (COGS) on your service business is normally a game-changer in phrases of bettering profitability.

- Let’s say you personal a junk removing enterprise, and you get a job to wash up an old building.

- A $3 price would be attributed to every widget beneath absorption costing if a factory produces 10,000 widgets and pays $30,000 in hire for the constructing.

Effective Management During Occasions Of Change: Guiding Your Staff By Way Of Transition

![]()

A service business should always ensure adequate capital within the financial institution to take care of its cash flow. This often involves strategic financial planning to ensure funds can be found to cover periods of high spending or to make prudent investments aimed at enterprise growth. The common price of all the products in inventory, no matter purchase date, is used to value the products sold. Taking the average product value over a time period has a smoothing effect that prevents COGS from being extremely impacted by the acute costs of one or more acquisitions or purchases. On a company’s steadiness sheet, stock appears underneath the section referred to as present assets. Gross revenue is a useful high-level gauge, but corporations must usually dig deeper to know underperformance.

How Do You Calculate Cost Of Goods Bought (cogs)?

At the tip of the 12 months https://www.kelleysbookkeeping.com/, the merchandise that weren’t sold are subtracted from the sum of beginning inventory and additional purchases. The ultimate quantity derived from the calculation is the cost of goods sold for the 12 months. Gross profit is the difference between net income and the price of items bought. Total revenue is earnings from all gross sales, while considering customer returns and discounts. Cost of products bought is the allocation of expenses required to produce the good or service on the market.

What Is An Example Of Gross Profit?

Maintaining track of this may help you see if you’ve priced your services properly and may help you retain a handle on the additional prices you’re incurring to serve your shoppers. There are bills that you’ll need to pay every month no matter whether or not you earn a dollar. When you separate out your COGS, it makes it simple to see what your complete indirect costs are. Calculating your true COGS may help you determine how much every service costs you by method of time and assets invested.

Service Business Specifics

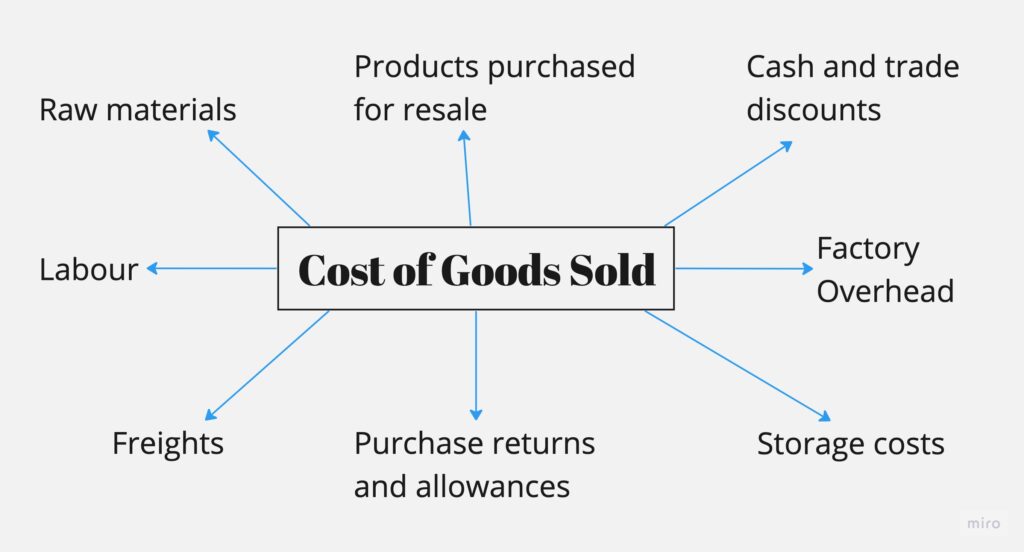

Understanding the price of goods bought method is prime to operating a profitable enterprise. Whether Or Not you’re a manufacturer tracking raw materials or a retailer managing inventory, correct COGS calculation directly impacts your gross profit and tax reporting. This comprehensive information will walk you through every thing you should grasp COGS calculations, from fundamental formulas to superior inventory valuation methods.

Deja tu comentario